PayPal Accounting Software Accounting for PayPal Transactions

Connect With PayPal is for merchants who want to allow customers to log into your website/app using their PayPal credentials. Alternatively, Zettle allows merchants to use Tap to Pay on iPhone or Android to accept contactless payments without using any sort of card reader or terminal at all. PayPal’s Zettle mobile processing app is not the most feature-laden POS around, but it’s a solid choice for smaller sellers. It features a more robust inventory system and card reader than PayPal’s previous mPOS system, PayPal Here (which has since been deprecated and is no longer operable). PayPal Invoicing receives mostly positive reviews, with a few complaints mixed in.

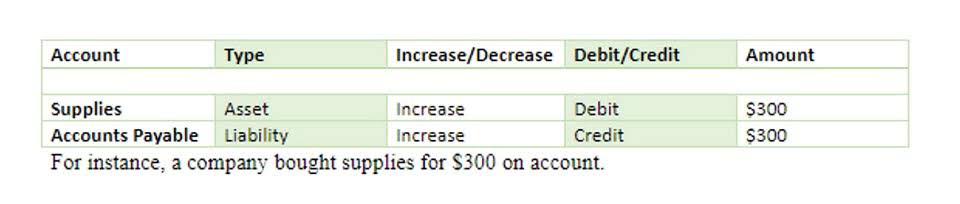

How to keep track of accounts payable

Both the lifecycle status and the payment/refund status of an invoice are tracked. The cost depends on your business needs and is not a one-size-fits-all answer. Regardless of whether your customers pay through an in-person card reader, an invoice or an online shopping cart, you will have to pay a transaction fee for each charge you make. These fees vary depending on the method of payment—for example, keyed transactions cost 3.50% plus a fixed fee of 15 cents while swipe/chip transactions cost 2.29% plus 9 cents per transaction (via Zettle). Keep in mind that PayPal charges an extra fee of 1.50% to process international credit cards while Square and Stax do not. Square’s card readers are also significantly cheaper, with the first one free and each additional one costing $10.

How to keep track of invoices and payments efficiently

Monday.com is a versatile project management tool that offers a highly visual interface suitable for various industries, including accounting. It allows teams to manage projects and track progress through customizable boards. Sync sales, fees, and taxes from multiple channels directly into your accounting software for accurate month-end bookkeeping.

How shipping integrations can make accounting more efficient by streamlining the order fulfillment process

PayPal’s marks in this category reflect the fact that the quality of PayPal’s live support, as reported by PayPal business users, is quite inconsistent. At the same time, we’ve taken into account the sheer number of 24/7 support options available and the comprehensive knowledgebase that reduces the likelihood that you’ll need live support in https://www.bookstime.com/ the first place. However, don’t think that everyone can process with PayPal just because anyone can open an account.

- In short, PayPal lets you accept payments on a website—an e-commerce store, for example.

- KashFlow connects to your PayPal account and retrieves details of sales, customers, purchases and suppliers.

- Traditionally, this means piles of paper and towers of dusty files cluttering the place and getting in your way.

- From secure payment processing to helpful business insights, we’re here for you.

- This includes a “Buy Now” button, a cash register at a retail store or a card reader at a restaurant.

- If you go through the BBB, the odds are good that you can probably get whatever help you need — it just might take a little while, and you should try going through PayPal’s customer support first.

Thankfully, you can easily go into your account settings and turn off interchange-plus pricing and revert to flat-rate pricing if you find that interchange-plus pricing isn’t saving you money. To trial balance compete with the likes of Klarna, PayPal has introduced two new pay later installment options, Pay in 4 and Pay Monthly. A separate feature, “Checkout on Facebook and Instagram,” allows you to sell products from your Instagram page while letting you use the full ecosystem of Instagram Shopping tools.

An Essential Guide to Pricing Client Accounting Services

Again, this reduces the risk of human error and accelerates the accounting process considerably. PayPal’s high score in this category reflects the fact that its merchant services are contract-free and have no early termination fee. Though this is standard with PSPs like Square and PayPal, we love to see this from merchant services providers. If you need your funds within minutes, PayPal offers an instant transfer option. It will cost you 1.5% of the transfer volume, which is on par with what Square charges for the same service.

Other aggregators, including Square and Stripe, have a similar reputation. Getting an account with minimal history is easy, but there’s an inherently higher paypal accounting risk because you’ll be under scrutiny once you get started. However, the lack of transparency in this process is the hardest part to defend.

- Help us to improve by providing some feedback on your experience today.

- Understanding the platform’s limitations is crucial for users considering PayPal for their financial transactions.

- Mango leads the pack in cloud-based accounting project management software.

- Signing up for a PayPal business account is free, meaning there are no initial setup costs, monthly charges, or cancellation fees.

- Luckily, accounting software integrations and automation of accounting processes can help simplify these tasks, freeing up time for other priorities.

- You’ll still pay for the software subscription, but PayPal charges nothing except the transaction fees and hardware.

What are accounting integrations?

Keep in mind that you’ll have to be logged in to a PayPal account to be able to utilize this support. The best POS system for your business depends on a variety of factors, including the type of business you have, your budget and the features you need. For many situations, it makes sense to invest in the best system you can afford and, preferably, the system can grow with your business.